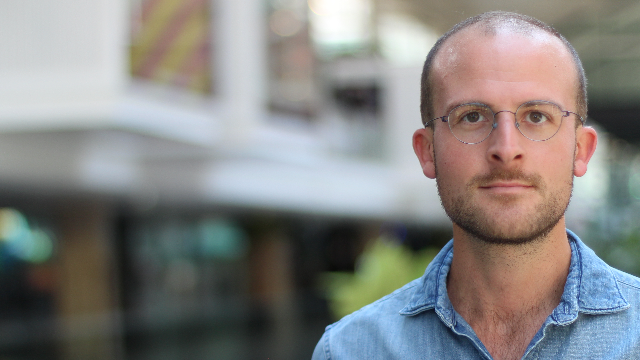

Bruno Lussato has created Eliosor: a new way for private buyers to finance their real estate transactions through joint investment

Can you tell us about your career since leaving EDHEC?

After a short stint with a strategic consultancy firm, I realised that what interested me most was entrepreneurship. That’s when I came up with the idea for my first company: Wistiki. The concept was to be able to find your belongings with small connected objects attached for example to your keys, which can then be geolocated using your smartphone.

Wistiki is a family affair, tell us more about that.

My two brothers and I set up Wistiki, with quite complementary skillsets: Théo and I both went to EDHEC, where I focused more on finance/communication and Théo on logistics/sales. Our younger brother, Hugo, went to Centrale Lyon, so he was primarily involved in the engineering side of things, even though he was only in his first year at the time.

We really learned as we went along. To put together the right team and work as a family, you need two things: to complement one another and trust one another. It was a bit hard to compartmentalise our professional and personal lives, that was one challenge, but apart from that it was a fantastic adventure that lasted a long time, almost 7 years. My brothers and I sold part of the company in 2016 and walked away from the business altogether in 2019.

You ran several fundraising campaigns, how did they go?

The most important thing when it comes to raising funds is to have figures to show to potential investors. To get off the ground, we ran a crowdfunding campaign, which enabled us to prove that our product was selling, and that attracted investors, even though we didn’t have the product yet as such.

In all, we raised close to €10 million in a few years.

Today you’ll be talking to us about Eliosor.

Eliosor is my latest entrepreneurial adventure. It allows people to use their real estate to fund their project without borrowing. We are in a position to help two types of people:

Property owners, by buying a small share of their real estate: 5, 10, 15 or 20%. They can use this money to do whatever they want: buy a new property, set up a new business, travel around the world, etc. The innovative feature of this is that it isn’t a loan; we jointly invest in their property. They then have 10 years to either sell the property or buy back our share.

People looking to become property owners. Here, we provide a down payment in the form of an investment worth 5/10/15/20% of the property. This enables the beneficiary not to borrow 100% of the price of the property, but perhaps instead 70%. This makes it easier to get financing from the bank.

Our remuneration doesn’t come from interest, as it does for the bank. If we invest 10% of the value of a property, we own a 15.5% share in it.

Did this model exist already?

It’s revolutionary because in Europe, nobody has used our mechanism to liquidate a share of their property and make this kind of original joint investment possible. A similar concept has been developed in the United States, and we took inspiration from it to develop our own here in Europe.

How do you attract investors?

By identifying clients in need of our service, in need of liquidity, and also by identifying investors keen to invest in residential property through Eliosor’s real estate portfolio. Eliosor, as a real estate company, purchases small shares of properties in geographic areas with high growth potential in real estate (mainly in the greater Paris region and the 20 biggest cities in France).

Any individual with €15,000 to invest in real estate can buy into the portfolio and invest their capital. We target an annual rate of return of 8%. But it’s also open to institutional clients, who will of course invest larger sums.

Is the objective to find investors or people in need of financing?

Both! There is as much demand from clients who come to see us because they need money as from those looking to invest in real estate.

Ultimately, that’s the very definition of a product-market fit: we bring together two groups that need each other.

Is this joint financing system a response to the difficulty of accessing property?

On the one hand the property market has really taken off, and on the other the banks are increasingly asking for down payments. It’s very tough for first-time buyers, they’re in a bind. So we bridge this gap for them. We can go talk to young people with jobs and offer them this joint investment, which will have the same effect with the bank as if they had a down payment. So clients can potentially take 10 years off their loan repayment schedule.

What parallel can be drawn between your two entrepreneurial experiences?

I think the link is that I have met two needs. With Wistiki, people were losing their belongings and we wanted to develop a fun and above all effective way to find them again using technology. With Eliosor, we started with the principle that when it comes to financing, either you have the money or you take on debt, there is no middle ground. We felt it was a pity that there was no innovative way to allow people fund their projects generally. And so we set about innovating in the world of financing through joint real estate investment.

What kind of relationship do you have with the banks?

Although it might seem we’re treading on their toes, our approach is much closer to partnership than competition. Because ultimately if I go see a bank and explain to them that I can provide down payments for several hundred of their prospective clients, they’ll be interested because it brings down the level of risk they face.

These partnerships allow us to offer our clients a joint investment but also help find them a bank loan. We offer them a comprehensive financing plan for their property.

What are your ambitions for Eliosor going forward?

The ambition is to disrupt the bank lending market and become an alternative to banks. We hope that in a few years from now someone who needs financing will think, “either I go into debt or I talk to Eliosor”. Our aim is to democratise the whole process so that people can be aware that via their real estate they can access a new financing tool.

Outside of Eliosor, you are also a business angel. What does that role offer you?

What interests me is being able to help entrepreneurs achieve their objectives. There are many entrepreneurs who have got in touch with me on LinkedIn to ask for advice or raise funds. Whenever I did offer advice, I felt it would be better to also be able to help them in a way that was more operational and tangible when it comes to financing – by investing – which is what I do now.

What links do you have with EDHEC?

I attended a few events in person before the public health crisis, one of which I really enjoyed about a year and a half ago at the Centorial, about the circular economy. And of course I still have many good friends from EDHEC.

To contact Bruno: via LinkedIn and via www.eliosor.com

Comments2

Please log in to see or add a comment

Suggested Articles